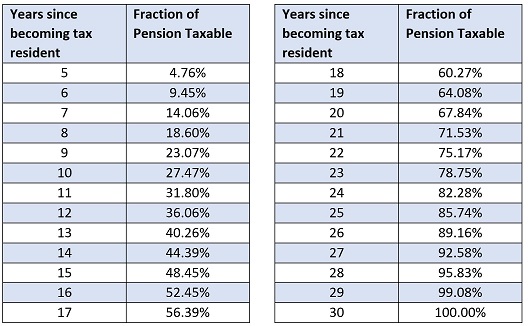

You can work out your tax obligation from the table above. Provided you have not opted out you are exempt transfer tax during the first four years, under transitional tax residency status. The table assumes the first 4 years are tax exempt and your tax liability starts from year 5.

If you became a resident on say the 22 April your exemption period ends 4 years after the month in which you qualified, that is fours years after the 30th April.

For example:

Let’s say you immigrated to NZ on 22 April 2016 and you transferred your pension with a value of $100,000 NZD on 20 August 2021.

You are deemed to be a tax resident from the 1st May 2016. Your first 4 years are tax exempt. Your tax exempt period ends 30 April 2020.

The 30th April 2021 is your 5th year of tax residency. The 20th August 2021 is deemed to be in your 6th year of tax residency..

From the table above, of the $100,000 transferred 9.45% is treated as taxable income. If your top tax rate is 33% then $9,450 is deemed to be your additional taxable income for the financial year. The amount of tax that you will pay at your marginal tax rate of 33% is $3,118.50.

Disclaimer: The information given here is by way of example. Lyfords are not tax accountants and do not accept liability. We recommend you discuss your situation with an accountant experienced in these calculations.