About Lyfords

Why Transfer

On-going Advice

About Us

Lyford Investment Management Limited is operated by Alison & Richard Renfrew. The company provides advice based on decades of experience. Both Alison and Richard have earned their Diplomas in Financial Planning, are Certified Financial Planners (CFP is an internationally recognised designation) and are Trusted Advisers (awarded by Financial Advice New Zealand).

Check out Meet the Team page for our other advisers and admin.

In addition to Lyfords UK Pension Transfer service, advice is available on wealth management, retirement planning, diversified investment portfolios, and personal insurance.

Why Transfer my pension?

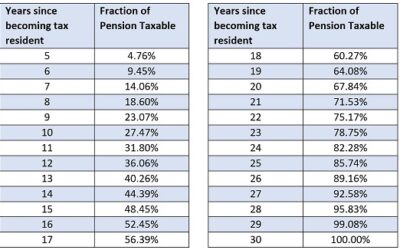

We can also inform you on how much tax you will pay when you transfer your UK pension to NZ.

— Scot F

— T B

Transfer Process

— Simon W

QROPS New Zealand News

Lyfords Fourth Quarter Newsletter 2025

Lyfords Fourth Quarter 2025 Newsletter For full detailed commentary, charts, and data available click on the link: 2025.Q4 Economic Commentary As we close out 2025, global...

What the April 2026 “Scheme Pays” rule means

A change in the New Zealand Taxation Rules now allows your HMRC approved, QROPS scheme provider to pay your transfer tax liability directly to the IRD at 28%. A new...

Lyfords Third Quarter Newsletter 2025

A Very Strong Quarter for Markets The third quarter delivered excellent news for most diversified investors. International share markets posted very strong gains, many reaching...