A change in the New Zealand Taxation Rules now allows your HMRC approved, QROPS scheme provider to pay your transfer tax liability directly to the IRD at 28%.

A new migrant or a Kiwi returning home after a decade abroad meets the criteria for “transitional resident tax exemption”. If you are transferring a UK Pension then you are exempt the transfer tax for the first 48 months.

This applies to defined benefit and defined contribution schemes, but not regular annuity payments, which remain taxable

If you emigrated say on 15 August 2025 then your four year exemption period ends 31 August 2029.

Current Rules:

There are two separate rules that you can use to work out your tax liability. You can select which one is more favourable.

Schedule Method:

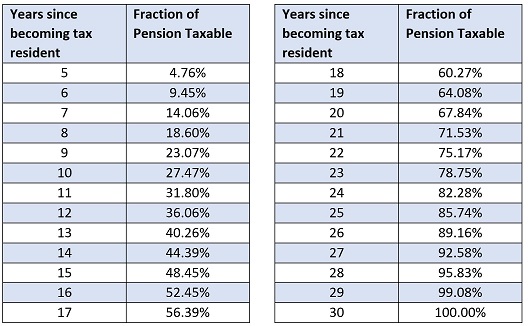

A percentage of the amount transfered is treated as taxable income after the 4-year exemption rule. This is detailed in the taxation increments table

The amount deemed taxable is taxed at your marginal tax rate.

Formula Method:

This only applied to defined contribution schemes. This method taxes the actual NZ-resident growth (opening value + contributions – withdrawals, adjusted for an interest factor). Often lower for short post-exemption periods or volatile currencies, but requires detailed records.

The tax that is payable must be declared on your IR3 return and cannot be deducted from the transfer value.

April 2026 Tax Rule Changes – “Scheme Pays” for Pension Transfers

Legislation passed in the 2024 Taxation (Emergency Response and Contingency Planning) Bill allows for a simpler, more flexible regime from 1 April 2026.

This is the Transfer Scheme Withholding Tax (TSWT). A flat 28% “scheme pays” mechanism for eligible transfers to NZ QROPS superannuation schemes.

This is ideal if you are in a 33% to 39% marginal tax bracket or have a large transfer.

Your NZ QROPS provider withholds 28% (TSWT) on the taxable portion (refer to the Taxation Increments Table) of the lump sum transferred and pays this directly to the IRD.

Optional – you can still choose what method you use

The Transfer Scheme Withholding Tax (TSWT) is optional, but you do need to notify your QROPS provider if you select this, otherwise they will leave the tax liability in your hands. Stick with the old methods if they yield lower tax (e.g., short post-exemption time + formula method). Or pay your tax liability personally at your marginal tax rate. The TSWT is ideal for 33% to 39% marginal tax holders, or if the taxable portion calculated from the Taxation Increments Table pushes you over into the 33% or 39% tax bracket.

Example: $100,000 UK Pension Transfer, After Your Transitional Tax Exemption

Take an investor who’s marginal rate is 39% and has been a NZ resident for 10 years. Using the table shown above (The Taxation Increments Table) we can calculate how much of the transfer value is treated as income and is subject to tax at their marginal tax rate.

| Scenario | Taxable Amount | Tax Rate | Tax Owed |

Net to You |

| Pre-2026 (Scheduled) | $27,470 | Marginal (39%) | $10,713 | $89,287 |

| Post 2026 (TSWT) | $27,740 | Marginal (39%) | $7,767 | $92,233 |

| Before off by $2,926 |

Disclaimer:

This isn’t financial or tax advice. Consult a qualified adviser for your circumstances.

Sources: IRD Tax Policy (2024 Bill), IR257/IR1024 guides, HMRC updates as of November 2025.

Tax Rules for Foreign Superannuation Lump Sums