Pessimism can be positive

While it may seem counterintuitive, investors should take some comfort from the recent spike in uncertainty.

Three professors from Stanford and Northwestern universities have developed an objective method to measure economic uncertainty, relying primarily on:

-

Newspaper searches tracking the frequency of articles discussing economic policy uncertainty,

-

U.S. tax policy uncertainty metrics, and

-

Divergence in economic forecasts for key macroeconomic indicators.

Since the mid-1990s, their work has produced a Global Economic Policy Uncertainty Index, providing a valuable lens on how uncertainty evolves over time.

A few key observations from the data:

-

Global uncertainty has steadily increased over the past three decades.

-

By the end of 2024, the index had spiked to its highest level on record.

-

It is reasonable to assume that uncertainty levels have climbed even higher since then.

Historically, periods of peak uncertainty have often been followed by stronger market returns over the following five years.

While volatility can feel unsettling in the moment, history suggests that moments of greatest uncertainty may ultimately offer some of the best opportunities for long-term investors.

Renowned investor Warren Buffett once famously said that to succeed in investing, one must “be fearful when others are greedy and greedy when others are fearful.“

This philosophy reflects Buffett’s own preference for paying a fair price for great businesses, rather than overpaying for companies whose valuations have been inflated by investor exuberance.

Throughout his career, Buffett consistently found it easier to uncover bargains when others were worried about the future, rather than when confidence — and asset prices — were soaring.

Today’s heightened uncertainty serves as a timely reminder of the value of remaining patient, disciplined, and opportunistic in turbulent markets.

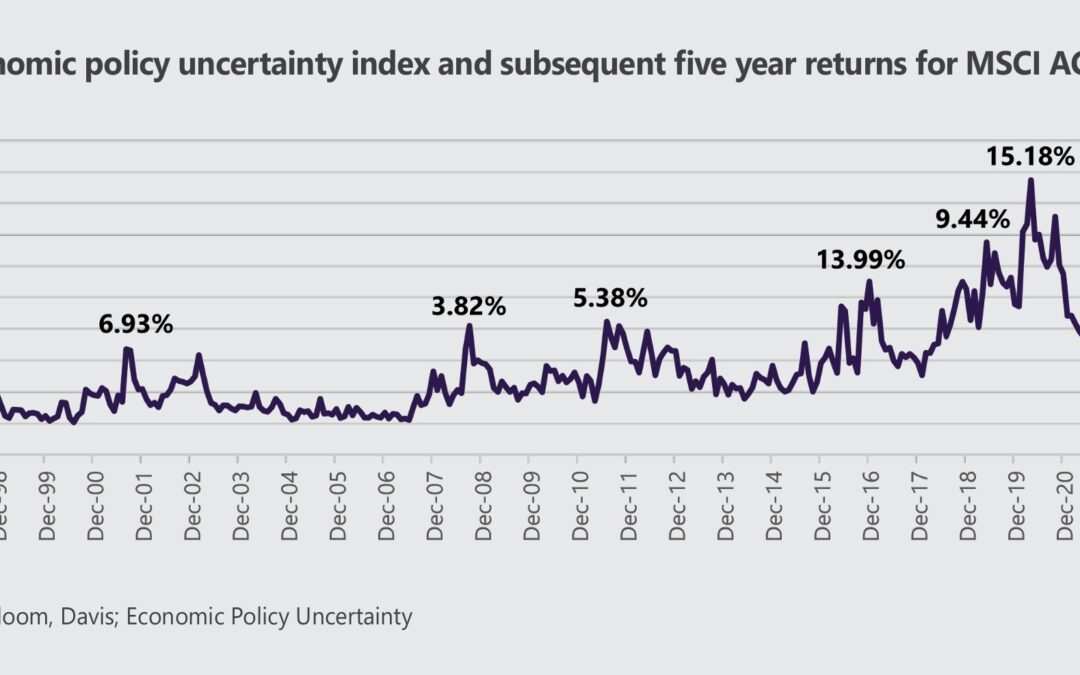

An important insight can be drawn from the chart above.

Above six of the temporary uncertainty peaks (periods where economic uncertainty spiked sharply), we have identified the subsequent five-year annualized returns for the MSCI All Country World Index (USD).

In short, the numbers shown above each peak represent how global shares performed over the five years following each surge in uncertainty.

The pattern is compelling:

-

In the later peaks (between 2016 and 2019), the subsequent five-year returns have averaged double-digit gains.

-

Historically, these moments of heightened uncertainty have proven to be great entry points into the share market — not times to exit.

This dynamic makes intuitive sense.

When uncertainty is high, fearful investors are often more willing to sell shares at steep discounts to escape the anxiety of an unpredictable future.

Yet the more discounted share prices become, the higher their future expected returns are likely to be.

At the latest uncertainty peak, we have placed a question mark — because it will take another five years before we know how shares purchased today will perform.

However, if history — and Warren Buffett’s wisdom — are any guide, there’s a strong chance that future returns will be highly attractive.

For any investor considering selling growth assets during times of elevated uncertainty, this historical pattern should serve as a strong deterrent.