Market reaction to new Trump tariffs

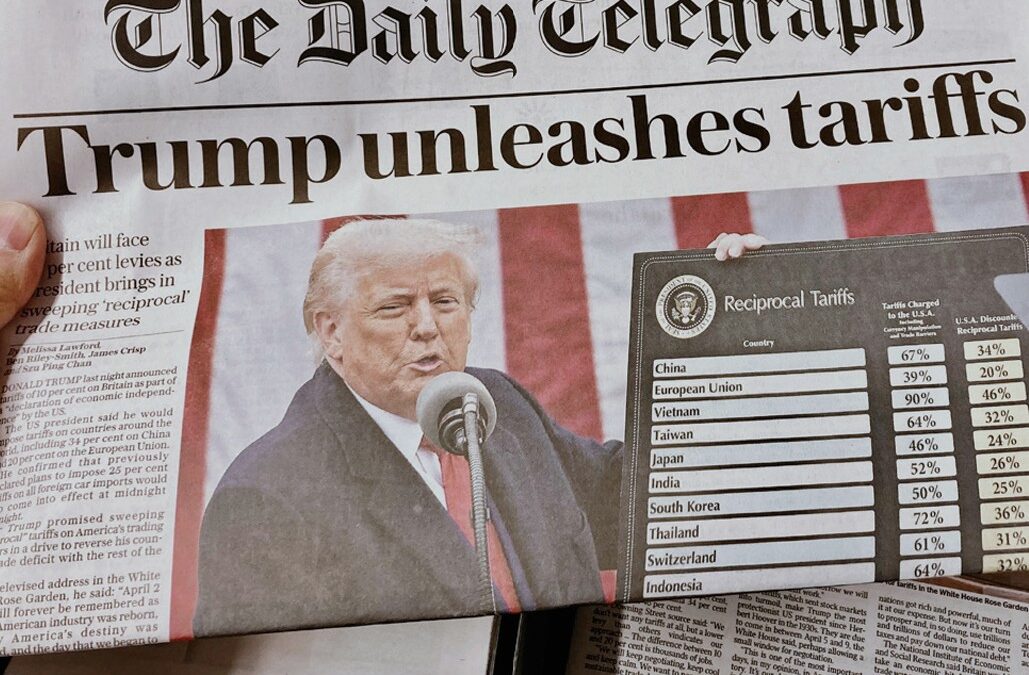

On April 2, U.S. President Donald Trump announced a sweeping set of international tariffs: a universal 10% tariff effective April 5, and additional country-specific tariffs affecting roughly 60 nations from April 9.

Markets responded sharply. Global share markets plunged, with the S&P 500 falling -4.8% on April 3 and a further -6.0% on April 4. Other major indices mirrored the downturn:

-

German DAX: down -8% over two days

-

Australian ASX 200: down -3.4%

-

New Zealand NZX 50: down -4.6%

Since then, markets have experienced high volatility, with swings between gains and losses — sometimes within the same day.

A temporary reprieve came with news that higher tariffs above the 10% baseline would be deferred by 90 days, sparking a significant market rebound. However, volatility remains elevated. In today’s environment, market valuations can shift dramatically in just a few hours, making real-time assessments challenging.

The key takeaway: the “white-knuckle ride” that began on April 2 shows no signs of easing. Markets are searching for clearer, more consistent messaging from the White House to stabilize.

While the deferral announcement was a positive signal, major questions loom:

-

Will higher tariffs become a permanent feature of U.S. global trade policy?

-

How will sustained tariffs impact inflation, interest rates, consumer demand, and economic growth?

At this stage, the long-term effects remain uncertain — and markets, as always, react poorly to uncertainty. That undercurrent of doubt has been the driving force behind the turbulent market activity seen through early April.

So far, the U.S. administration’s communication around the new tariffs has been disjointed and inconsistent.

It’s not that a well-reasoned case for revising tariff settings couldn’t be made — in some cases, it could. The issue is that the rationale behind these sweeping changes has been delivered in a haphazard and confusing manner.

This lack of cohesion has drawn sharp criticism, with many pointing to an absence of clear logic behind the policy rollouts. In turn, it has only intensified the uncertainty rattling global markets.

At this point, observers are left to speculate:

-

Is this simply a trade negotiation tactic, designed to be quickly reversed if concessions are won?

-

Or is it part of a broader, large-scale economic experiment, rather than a finely tuned strategic plan?

Time will tell.

For now, the rest of the world is scrambling to assess the true implications, while markets are struggling to find their footing amid the upheaval.

With any luck, greater clarity will emerge as the second quarter progresses, helping both policymakers and investors better navigate the uncertain road ahead.