While the impact of Covid-19 on world economies has not fully played out and portfolios have taken a hit; in my opinion, we are not seeing a free fall in share markets. If you look at the US market from its high at the beginning of February to its low on 23 March we saw a 34% drop, then a 17.5% recovery from this low. These markets appear to have bottomed, although time will tell.

These are unprecented times, but history can teach us a few things.

WHAT CAN WE LEARN ABOUT THE FINANCIAL MARKETS FROM HISTORY?

Benjamin Roth was a lawyer in Youngstown, Ohio, when the stock market crashed in 1929. Two years later he decided to keep a diary to detail the effects that the financial collapse had on himself, his neighbours, and the nation. Mr. Roth kept his diary for ten years. In the late 1930s, when the depression had mostly passed, he summarised a few points he had learned from the experience. He wrote:

“Business will always come back. It will remain neither depressed nor exalted…. Depression is a time of greatest profit. The investor who has liquid funds and the courage to act can lay the basis for great profits.”

If I could summarise these words of Mr Roth, I would say, “Whilst any business can go out of business. Business itself will never go out of business.”

In a recession (or even a depression) some businesses will fail. They could be businesses chasing unprofitable objectives, businesses overloaded with debt or businesses shackled with poor management. The odds of those businesses failing will be reflected in their price. Each day, every day, the share market is weighing those odds and pricing them accordingly.

WHAT WILL HAPPEN TO BUSINESSES?

One thing is 100% true:

Business in general, the trading of goods and resources, has never gone out of business. It stared down the great depression. It stared down World War II. It stared down the oil embargoes. It stared down the global financial crisis. And it will stare down the pandemic of 2020 as well.

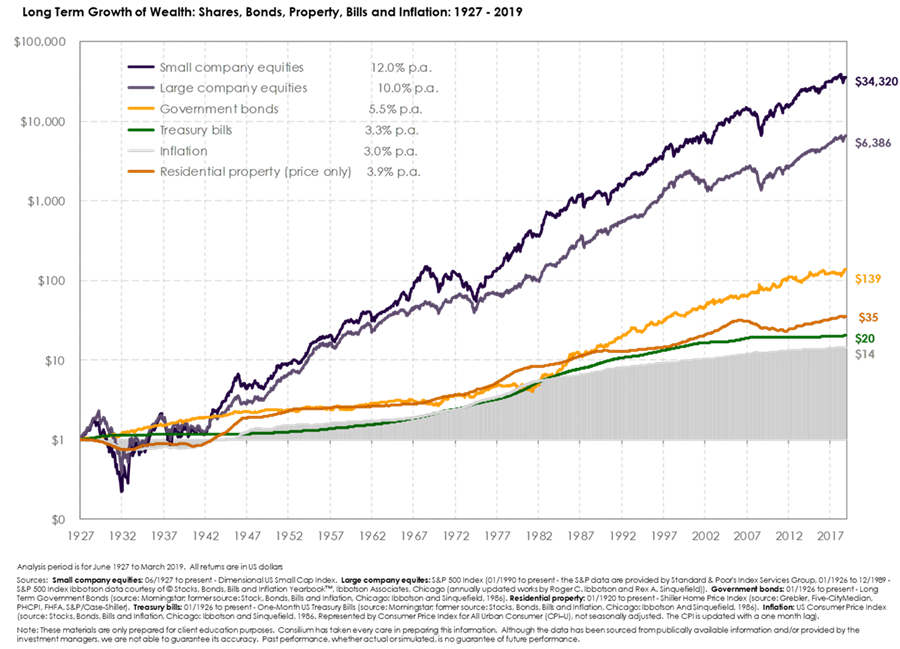

The chart below illustrates the point. It shows the growth of various US financial market assets over the last 90 or so years.

There are many things that could be learned from this chart, but today I’d just like to make the most obvious of points. All lines trend up. Business has never gone out of business.

WHAT WILL COVID-19 MEAN FOR INVESTMENTS IN BUSINESS?

Now it must be observed that many businesses have failed in the last 90 years. In fact, only about 10% of the original list of S&P 500 firms are still in the S&P 500 today. Yet, for each firm that came and went, another took its place. That’s no concern to diversified investors. An investor who did little else but invest in the index earned about 10% per annum (represented by the large company line above). It didn’t matter to them that 90% of the businesses came and went. Sure, many businesses failed. But business never went out of business.

Fortunately for our investors this is the way their portfolio is structured. They don’t own a single “business” as much as they own “business” in general. Many of our clients have portfolios diversified across more than 8,000 companies traded in over 44 different countries with operations extending around the planet. In effect, they own the power of global capitalism to produce and manufacture goods and services that people want to pay for. This investment has had its up and downs. But such an investment has never failed. Through each and every crisis throughout history, business has survived and thrived every time.

A DIVERSIFIED PORTFOLIO

So, let’s again quote Mr Roth above, “Business will always come back.” And because it will always come back Mr Roth’s second observation is also true. When things are bad and prices are low, “The investor who has liquid funds and the courage to act can lay the basis for great profits.”

It was true in the 1930’s and it’s just as true today. Because if history tells us one thing, it’s that business will never go out of business.

MORE RECENT MARKET TRENDS

Let’s look at a more recent share market correction: March 2nd 2009. Across America people woke up to the headline, “Stocks fall to lowest level since 1997 as Dow drops below 6,800.”

The expectations were that it would go even lower and for good reason. More bad news was on the way.

At the start of April, the New York Times announced that 663,000 jobs were lost in March in the US alone. Later that month, George Soros, one of the most successful investors of all time, said US Banks were basically insolvent. On May 1st, Chrysler filed for bankruptcy, followed one month later by General Motors. The economic outlook was still bleak in June when Warren Buffett said that the US economy was a shambles and not showing any signs of recovery.

By March 2009, shares had fallen in value by about 50% and, to all observers, markets were getting worse not better. And they were right, as evidenced above. But a strange thing happened. Shares started going up. In March alone, shares as measured by the S&P 500, increased in value by a little over 8.5%. Then they went up another 9.5% in April and a little over 5.5% in May.

HOW SHARE PRICES RECOVERED IN 2009

In other words, share prices started to rise before the economy started to recover. They didn’t start to rise when the crisis was in hand. They didn’t start to rise when the banks were clearly solvent. They didn’t start to rise when the bankruptcies had all finished being filed. They didn’t start to rise when the job losses had staunched. No, they started to rise when further economic deterioration seemed a near certainty.

Economist and Finance Professor Dr Robert Arnott put it this way:

In other words, share prices started to rise before the economy started to recover. They didn’t start to rise when the crisis was in hand. They didn’t start to rise when the banks were clearly solvent. They didn’t start to rise when the bankruptcies had all finished being filed. They didn’t start to rise when the job losses had staunched. No, they started to rise when further economic deterioration seemed a near certainty.

Economist and Finance Professor Dr Robert Arnott put it this way:

“In investing, what is comfortable is rarely profitable.”

The market environment in March 2009 reinforced the wisdom of these words.

WHAT WILL HAPPEN IN 2020?

As we look at the current crisis, none of us knows when things will turn around. But one thing we can be sure of, it won’t turn around when the Center for Disease Control and Prevention rings the bell and gives us the all clear! It won’t be when the Central Bank gives a rosy report and starts to raise interest rates again. No, by then shares will have already been on the way up for a long time.

THE TAKEAWAY:

Don’t miss the recovery, and especially don’t miss it waiting to feel comfortable. That’s not likely to be a profitable strategy.